Car Insurance in ludhiana

Apna Finmart presents the satisfactory automobile coverage services in ludhiana. Protect you and your car from unexpected problems with car coverage. We have partnerships with primary insurance issuers, we give a number of vehicle insurance options for distinct needs and budgets. Our insurance includes herbal emergencies, theft, twist of fate, and third celebration liability coverage. Our dedicated workforce enables you to select the right insurance policy. With Apna Finmart, you can drive with self belief knowing that you have dependable aid and protection.

Life insurance in ludhiana

Overview Life Insurance

Life insurance offers cover to your life and your family members securing their future financially in the event of an unfortunate incident. Sudden death or critical illness can create a panic situation, stress and loss of income too. While there is no replacement for the life gone, not having to worry about financial stability helps the family a great deal in recovering from the loss. Life insurance is the right instrument to secure your family’s finances after your time. Today, the risk factor in any individual’s life has only increased. It could be due to medical issues, lifestyle concerns, special illness, accidents and alike.

Car loans work along the same rules and processes that are applicable to various other loans. For most of the situations, during purchase of car, the borrower will apply for a specific car loan. The consumer may also utilise a personal loan for purchasing car.

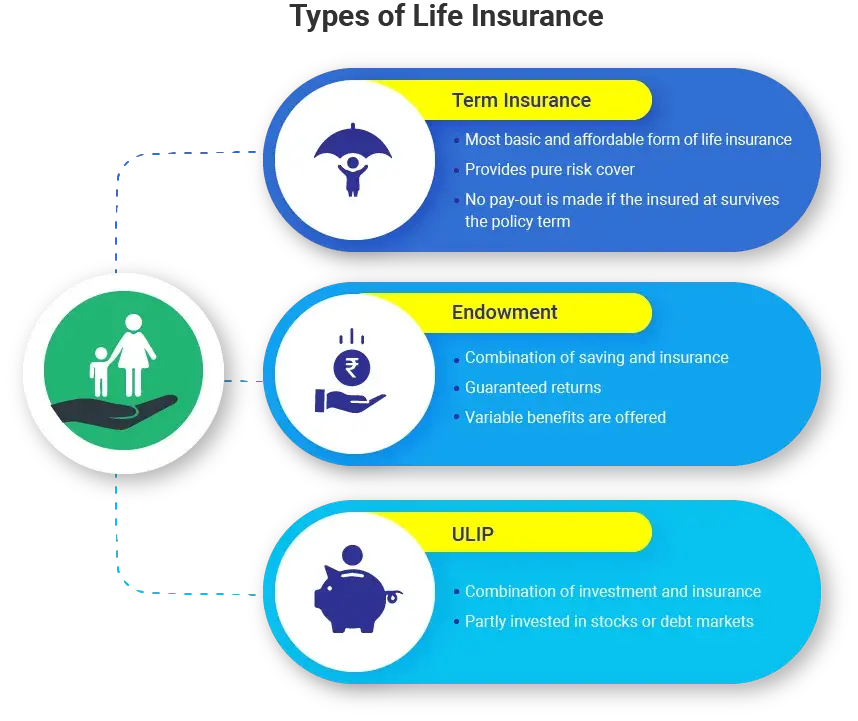

What is Life Insurance?

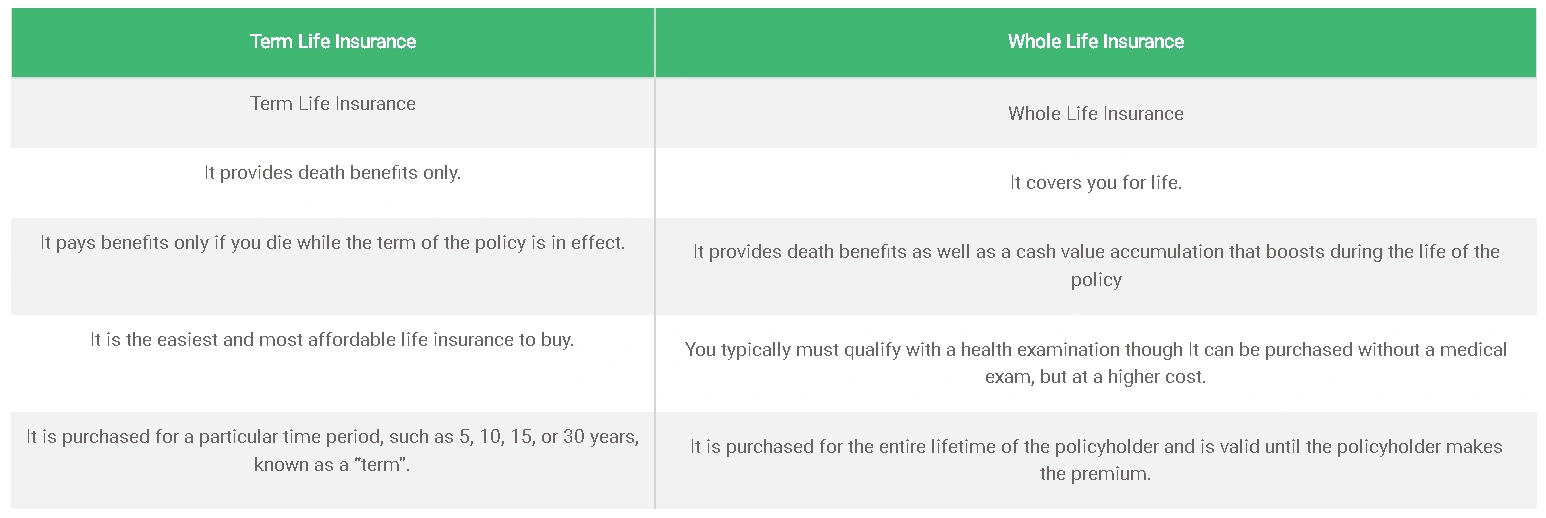

Life insurance is a contract or agreement between the insured and insurer that a lump sum will be paid to the beneficiary in the event of a death in exchange for the premium paid. Depending on the contract, the insurance policyholder or the insurer can claim for payment on other events such as terminal illness or critical illness. Other expenses such as funeral expenses can also be covered.

Life insurance can be bought to protect against such incidents. One needs to pay small amounts of money at regular intervals of time in return for such financial protection. It helps in keeping your family away from financial distress in case something happens to you. The protection starts only after a certain period of premium payment is made. Life insurance has been made affordable to all. The premium depends on many factors like age, gender, medical history, job profile, etc.

Key Benefits of Life Insurance

Life insurance is an essential part of your financial strategies, helping to ensure a more secure financial future for your beloved ones when you're gone. Not only does life insurance help cover unexpected final expenses, it can also provide your family with a financial safety net or even serve as an inheritance. Financial security and protection are what an individual long for, and life insurance is a perfect answer to that. There are many advantages of availing life insurance, financial security and protection are the most important ones. Others are:

1. Protection

Life insurance provides you with high protection as in terms of financial help that keeps you and your family protected in case of an unfortunate event. For example, your family may have to find the money for mortgage, debt, funeral expenses, bills, income replacement and more.

2. Death Benefits

Investment in a life insurance policy is a safe and better option for you and your family. At the time of contingencies and emergencies, the beneficiary will be able to get the sum assured to compensate for the future need or current expenses i.e. the sum assured plus the bonus to the bereaved family. Life insurance also protects the interest of people who have decreasing incomes with advancing age, people who meet with accidents or for retired people. There are a number of policies available and you can choose the policy that will best suit your requirements.

3. Return On Investments

In this benefit when the policyholder is still alive after the term of their life insurance policy is up, they can get the amount they put in as premiums, tax-free. It basically refunds your premiums if you outlive the policy. Consider a policy with Rs 5 lakh cover for 20 years for which the yearly premium is Rs 500. If the policyholder dies, the family will be paid the sum assured, that is, Rs 5 lakh. However, if the policyholder survives the term, the insurer will return the premium of Rs 10,000 (Rs 500 x 20).

Life insurance schemes are a better investment when compared to other investments because it yields more. It offers bonuses that no other investment scheme can offer. The money invested in life insurance covers risks and is very safe. The money invested will pitch good returns and will be sorted out fully as the sum assured either after the completion of the term or after the death of the policyholder. Both ways the money invested, and the returns are paid back safely.

4. Tax Benefits

To reduce tax liability, Section 80C of the Income Tax Act is an effective way for the salaried person. Under this section, investments made in the specified instruments are subject to rebate. Currently, the amount available for rebate under section 80C is Rs. 100,000 which can be invested in life insurance premiums, pension superannuation fund, employee provident fund, equity-linked mutual fund schemes, National Savings Certificates and public provident fund (maximum Rs 70,000). The amount invested in these instruments is eligible for a rebate through deduction of the amount from gross taxable income.

5. Loan facility

Life insurance provides you with the advantage of taking a policy loan in case you are urgently in need of money. The loan can be borrowed against permanent or whole life insurance only. Interest rates on loan against the insurance policy are usually much lesser than a personal loan. If the interest due on the loan exceeds the surrender value, the policyholder runs the risk of losing the insurance cover.

Health Insurance in ludhiana

What is health insurance? – The Basics

Health insurance is an insurance product that covers your medical expenses. Just like a car insurance that provides financial coverage for your car if you get into an accident, health insurance offers you financial assistance if you fall sick or get injured.

Just like all other insurance policies, health insurance is an agreement between an individual or a group of persons and the insurance company. The individual pays annual premiums to the insurer, who in return, offers financial assistance to the insured during a medical crisis, subject to terms and conditions mentioned in the policy.

Generally, health insurance cover offers coverage for the following expenses – hospital room and boarding expenses, fees of surgeon, physician, specialist, anaesthetist, consultant, nurses, costs of blood, oxygen, surgical appliances, anaesthesia, x-ray, dialysis, drugs, medicines, operation theatre charges, radiotherapy, chemotherapy, pacemaker, transplant organs, artificial limbs and many more.

Apart from these expenses, a health insurance plan also offers coverage for pre and post hospitalisation expenses, preventive care, diagnostic tests, ambulance charges, hospital cash allowance, domiciliary care and much more, depending upon the terms and conditions of your policy.

Who should purchase a health insurance?

Though health insurance is not mandatory like car insurance, it’s highly recommended that everyone avails a health insurance policy. With mounting medical costs and an increase in the number of lifestyle diseases, it’s not possible or practical to pay out-of-pocket for medical emergencies. Medical expenses are one of the major reasons for families to fall into debt traps. With a health insurance cover, you can protect your family’s finances during a medical crisis.

Why is health insurance important for all?

It’s no surprise that healthcare costs across the country have increased significantly. That compounded with our hectic lifestyle, takes a toll on our health, making health cover critical for all, irrespective of one’s income levels. When you have health insurance, it offers you financial assistance in times of medical emergencies.

Without a health insurance plan, you would be forced to dip into your life’s savings to pay for your medical expenses or worse to avail a loan. Both these options dent your family’s finances, jeopardizing your current savings and future investments. A medical insurance plan acts as a financial net, assisting you during a medical emergency.

What is health insurance? – The Basics

The rising cost of medical treatment in India

Medical costs in India have been increasing year-on-year. According to data released by the WHO, India’s annual spend on public healthcare is just 4.7% of the GDP. This means the vast majority of the citizens have to rely on private treatment for various health issues.

Additionally, the average costs of medical expenditures in India are increasing by 15 to 20% every year. Specialist treatment, new advances in medical sciences, and inflation all make healthcare expensive. Very often, when an individual in a family faces a medical emergency, the entire family’s finances are in a toss.

Lack of finances could even lead to delayed or insufficient treatment. Most families today take loans, sell assets, dip into their personal savings, or mortgages to provide healthcare for their family member. A health insurance plan acts as a real lifesaver providing you the cost of hospitalisation, pre and post hospitalisation expenses, surgeries, doctor fees, other treatments, and more.

Increase in lifestyle diseases and critical illnesses

Our lifestyle has undergone a drastic change in the last couple of decades. We have moved from labour intensive jobs to sedentary jobs that have led to an increase in lifestyle diseases like blood pressure, diabetes, obesity, cardiac problems, and more.

Not just lifestyle diseases, the cases of critical illnesses like cancer, cardiac arrest, and kidney failures also have increased steadily over the years. Hectic lifestyles, chronic stress, irregular eating habits, improper diets, lack of exercise, and not to forget urban pollution – are all making us ill. Health issues can arise at any time and to anyone.

A medical insurance plan will provide your family with much-needed financial stability during a medical crisis. It will take care of most of the expenses, and you can focus on providing your loved ones with support and attention. Additionally, cashless facilities offered by several health insurance plans make it possible to get treated at network hospitals without paying a single rupee out of your pocket.

With health insurance, your family is not burdened financially during a medical crisis. The huge range of benefits offered by health insurance plans far exceed the nominal premiums you have to pay for the plan.

Benefits of Health Insurance Policies

Are you still debating whether you should get a health insurance policy or not? A health insurance plan offers several obvious benefits like – protects you from medical contingencies, helps you avail cashless treatment at hospitals, prevents you from burning a hole in your pocket paying for medical expenses and safeguards your family from money problems during medical emergencies. Apart from these, there are several other benefits offered by health insurance policies. They are:

Provides you with best-in-class medical treatment

Today, medical expenses can very well run into lakhs of rupees. This makes it difficult for regular families to pay out-of-pocket. The result – they either delay treatment or compromise on the treatments. With a health insurance policy, you don’t have to worry about the costs of treatment as it is handled by your insurance company. You can avail cashless treatment at the best-in-class hospitals in India, without burning your life savings. Most health insurance policies offer coverage for – in-hospital expenses, pre and post hospitalisation expenses, medical expenses, surgery costs, equipment costs, medical practitioner fees, ambulance charges, room costs, daily cash allowance, cost of medicines and pills, and much more.

Convalescence Benefit

Also known as recovery or recuperating benefit, health insurance policies also provide you coverage for expenses that occur after discharge from the hospital like – further diagnostic tests, physiotherapy charges and more.

Alternative Treatment

Apart from regular allopathy treatment, several health insurance policies today offer coverage for alternative modes of treatment like Ayurveda, Unani, Siddha, Homeopathy, Naturopathy, and many more.

Domiciliary Treatment

Attendant Allowance

Daily Hospital Cash Allowance

Free Health Check-up

Dental Treatment

Cosmetic and Bariatric Surgeries

Travel Insurance in ludhiana

Introduction

Travel Insurance is a type of insurance policy which gives you risk benefits while you are traveling in and around India. “Better to see something once than hear about it a thousand times”. Traveling could teach you life lessons. It could be a getaway with your family or a business trip or solo trip or anything. Some of the most cherished memories are from the times when traveling. When you travel, you come across things that you could never experience at home. You may see beautiful places and landscapes that you never thought existed. You may meet people that are so different from you, your life, and your thinking. Also, may try adventurous stuff that you have never tried before. When you come home from a trip you feel refreshed and energetic. During your trip, you may learn a lot of things that you will want to try at home as well. You may want to assess your new skills and knowledge. Your experiences will give you a lot of motivation and energy.

It is highly recommended purchasing a travel insurance plan in case of any losses or risks that might occur during various trips such as family trips, solo trips, business trips or for studying abroad. Travel insurance is to protect you and your family from any uncertain circumstances while you are away.

In the year 1919, GMAC authorised desks in various North American cities. While car loans were there, majority of American consumers paid cash for their automobiles in the first half of the century.

Types Of Travel Insurance

You can choose from various coverage to get on the basis of your specific requirement. Travel plans and policy offer covers various possible emergency situations during travelling.

1. International Travel Insurance

International travel insurance provides protection from numerous incidents for overseas travellers during international travel. It provides nearly all kinds of coverage for baggage and travel delays, medical expenses overseas, hijacks, repatriations/evacuation to India, and loss of travel documents/passport besides the usual coverage.

2. Domestic Travel Insurance

Domestic travel insurance is for customers who are travelling within the country borders. It provides coverage for permanent disability and death, medical emergencies, travel delay, personal liability and checked-in lost or stolen baggage. The eligibility is generally between 18 to 65 years and varies from plan to plan. Any person, travelling in India or working with a permit in India can also buy this type of insurance. Domestic Travel Insurance comes packed with the assurance that you won't have to spend anything for hospitalization expenses and medical treatment in order to manage and cope with unforeseen hassles. With this guarantee, comes a feeling of security peace of mind, especially when you're travelling to an exotic domestic travel destination.

3. Student Travel Insurance

Student Travel Insurance is a travel policy just for students travelling abroad on a student visa to pursue higher studies. The plan covers students who are going to colleges, universities or institutes in a foreign country for academic or professional courses. There is only such minimum paperwork involved in student plans. The coverage is dealing with all elements and provides for expenses incurred on passport loss, medical treatment, and study interruptions.

4. Medical Travel Insurance

Medical travel insurance is a short-term travel insurance plan formulated to cover specifically the health care and medical expenses incurred such as medical emergency and evacuation etc. when an individual travels overseas. The exact inclusions and exclusions depend upon the insurance provider from whom the medical travel insurance plan is purchased.

5. Group Travel Insurance

Group travel insurance is a type of travel insurance policy that covers a group of people who are not related to each other by family and are travelling to a faraway place together. This group of people could be members of an association, who are going on an international trip to participate in an activity or business venture or anything. A group travel insurance policy in such a case saves tons of money on the premium.

6. Family Travel Insurance

A family travel insurance plan is an insurance policy that insures the entire family of the insured individual from travel-related emergencies. The family refers to two adults aged below 60 and two children aged below 21. If any of the children cross the age limit of 21 then it is suggested to get a different policy for each one. This plan covers hospitalization charges, baggage loss, and other incidental expenses. The claim payment is easy with minimal paperwork involved.

7. Senior Citizen Travel Insurance

Senior citizen travel insurance is for those who belong to the age group of 61-70 years. It is a travel medical insurance policy aimed at senior citizens to mark their travel as an amazing impression. It includes coverage for cashless hospitalization and dental treatments besides the usual benefits associated with travel insurance.

8. Single Trip Travel Insurance

The single trip travel insurance policy provides coverage for the duration of a single trip. It takes care of medical expenses and non-medical expenses during travel including coverage for loss of checked-in baggage.

Home Insurance in ludhiana

Introduction

We offer whole home insurance solutions at Apna Finmart in Ludhiana to defend your belongings and assets from sudden events. In order to guard your house and the whole thing in it, our domestic coverage guidelines provide insurance against dangers consisting of hearth, robbery, climate-related activities, and accidental damage. We deliver a number of insurance options catered on your wishes and finances by means of partnering with leading insurance companies. Our pleasant staff enables you to pick out the proper insurance, give an explanation for every element of the coverage, and efficiently manipulate claims. You can enjoy your living area more when you have peace of mind about your property's protection.